Expect The Unexpected

A financial plan, by design, is a way of preparing for the future and ensuring that you have enough money to get you through retirement or another life event.

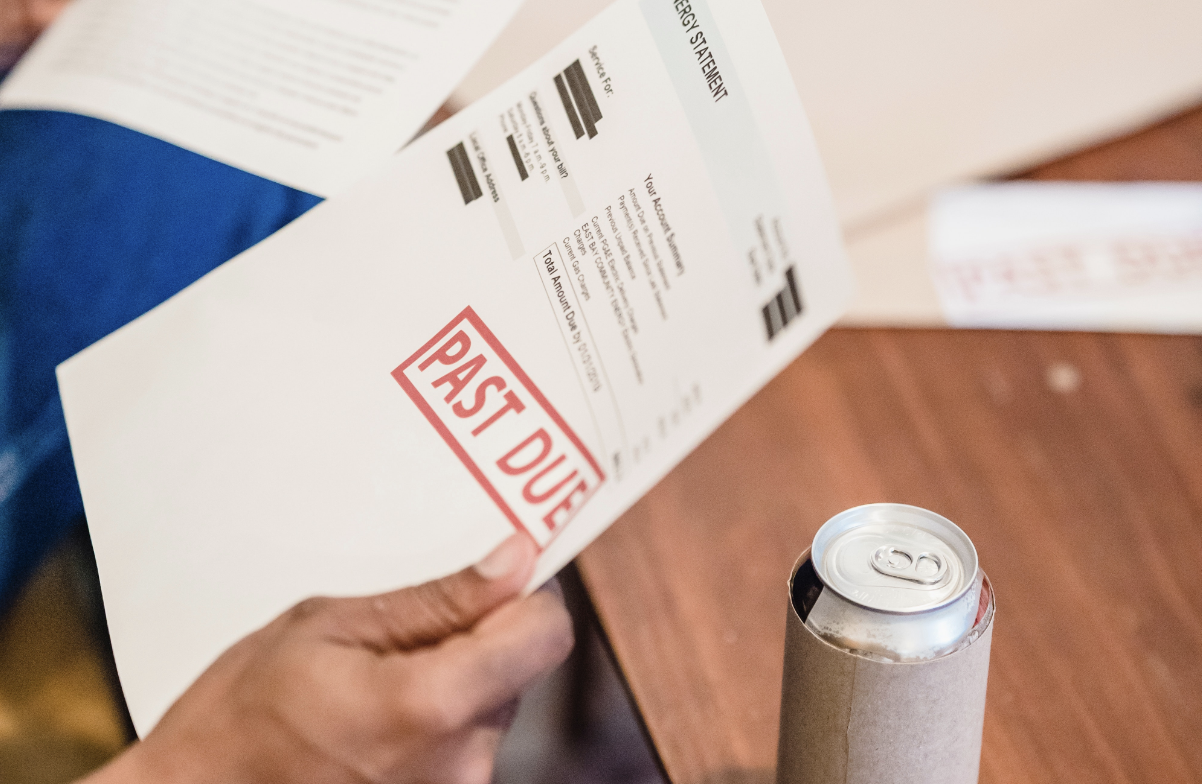

But what happens if you’ve got just enough to live off of in retirement, but then the unexpected happens (like illness)?

Your savings will diminish quite quickly, is what!

Even if you don’t have pre-existing conditions, it’s wise to add extra to your savings for medical emergencies. It’ll help alleviate some of the potential costs of treatment that could pop up.

If you have an existing condition, pay close attention to what your medications cost, and prepare for inflation when you plan for the future.

A good insurance plan will also help you in the long run. Ideally, like all insurance plans, you won’t need to use it, but you’ll be thankful it is there if you ever need to.

There’s no way to tell just what lies ahead. That’s why we do our best to consider all the variables and ensure that our clients are well prepared for anything they may encounter in the years ahead.

Ready to get started on your financial plan? Call us at (330) 836 7800 ext.1 or book a complimentary consultation online here.